Private Equity Real Estate Investment Firm

Om Equities LLC is dedicated to making your journey into the Real Estate Investment profitable by combining its core power of vertical integration and 80+ combined years of experience in Real Estate Development and Management.

Our Core Strength

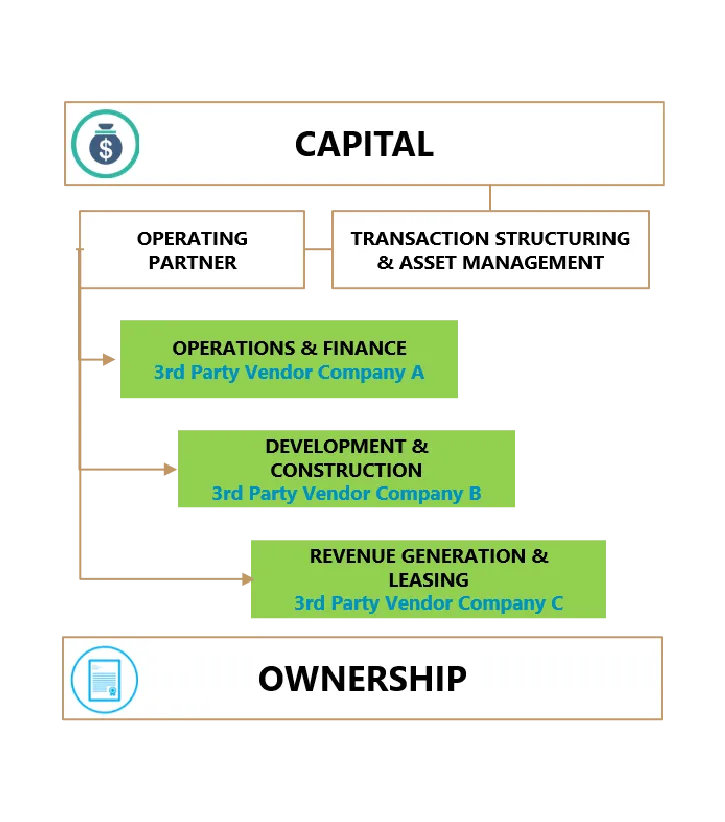

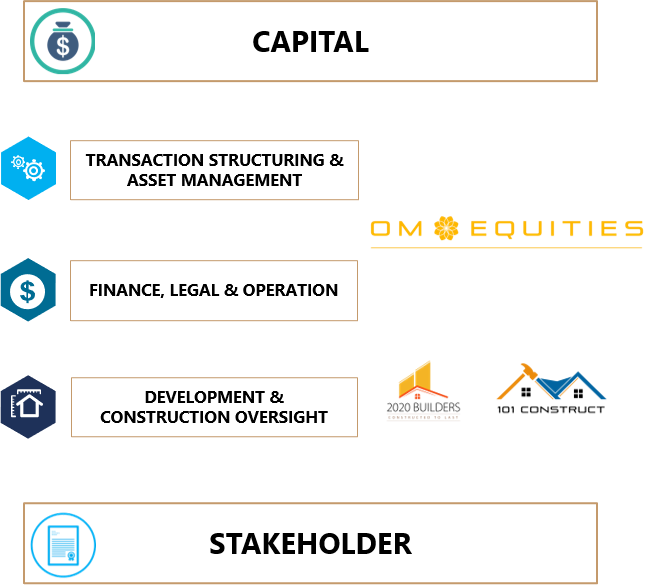

Vertical Integration

VS

Team

Our Experienced Team is Always Here to Help

Rajeev K. Kaura

Founder/PresidentRajeev is a highly effective results-driven leader and professional, with extensive experience in operations management, real estate portfolio asset management, investments, development, raising capital, wholesale mortgage banking and retail mortgage lending and underwriting. Rajeev has worked extensively in real estate development, project management, building relationships with municipality agencies to change land use, increase density, and approval of utilities. Rajeev has a proven track record of providing strong leadership, formulating business strategies and effectively overseeing day-to-day business operations. Adept in identifying priorities, establishing objectives, planning and executing viable projects, allocating resources, securing new business and delivering results with a tangible impact on efficiency, and profitability. Rajeev holds a BS in Business Administration from UC Riverside and an MBA from University of Redlands, California.

F.A.Q

Frequently Asked Questions

-

What are the requirements?

You must have the designation of an "accredited" or a "non-accredited" investor to display a sound level of financial and investment competency.

A "non-accredited" investor or sophisticated person means the individual, the company, or the private fund offering the securities believes that the person has satisfactory knowledge and experience in financial and business matters with adequate assessment of merits and risks involved.

An "accredited" investor meets the following criteria.

• They have earned and surpassed an income of $200,000 individually or $300,000 collectively with a spouse, each year for the past two years, and are expecting to achieve the same in the current year. OR

• They have a net worth of more than $1 million, individually or collectively with a spouse (excluding the value of a person’s principal residence).

On the income test, the person must satisfy the thresholds for the three years consistently either alone or with a spouse, and cannot, for example, satisfy one year based on individual income and the next two years based on joint income with a spouse. The only exception is if a person is married within this period, in which case the person may satisfy the threshold on the basis of joint income for the years during which the person was married and on the basis of individual income for the other years.

Additionally, entities such as corporations, partnerships, banks, non-profits, and trusts can be accredited investors. The following information maybe important to you:

• Any trust, with total assets over $5 million, not formed for the specific purchase of the subject securities, whose purchase is directed by a sophisticated person, OR

• Any entity where all the equity owners are accredited investors.

• Applications will be sent upon request.

-

What is the minimum investment?

The minimum investment is $100,000 USD for any project determined by the investment property. We can guide you on how to invest using your current IRA/401K monetary amount with no penalty from a third-party self-directed custodian company. For more details, kindly get in touch with us.

-

Can I invest through my IRA, LLC, LP, or Trust?

Absolutely. Investors can invest through traditional self-directed IRAs, or additionally through LP, LLC, or Trust as well. For any queries or help, kindly contact us.

-

What are the risks of investing?

Despite the regarded safety of multi-family properties amid numerous investment asset classes, there is a risk present in every investment. To manage the risk adequately, we obtain "below-market" and "off-market" deals by utilizing our sound relations with local brokers. By partnering with the local and experienced property management companies, we have better insight on which neighborhood market should be invested in. This ensures that the property is managed efficiently by maximizing income and reducing expenses. Investment procures no guarantee, yet we invest our capital into deals to ensure that our interests and goals align with the investors.

-

How long do I commit my money to this investment?

Investors can invest their capital for 18 months up to a 5 year hold period before opting for an exit strategy. The time period can vary according to each property’s business plan, and the strategy may alter due to economic conditions. Investors will be provided projected timelines upon the property’s acquisition and throughout the investment’s life. As sponsors, we will always remain faithful with the initial projection and will strive to maximize the returns for all investors with an excellent execution strategy.

-

What kind of returns can I expect?

Each multi-family property is unique and there is no guarantee on the amount which can be gained through return on investment. Despite this, we strive to achieve a double-digit annual return with no guarantees over the investment’s life period. This is obtained through cash flows, profits from property’s disposition, and forced appreciation by adding value. Additionally, we target a 10+% Internal Rate of Return (IRR) over the investment’s life period. For each investment property, we discuss the projected returns, business plans, and equity structure. As sponsors, we invest our capital into the properties and opt to maximize returns for the investors.

-

How often should distributions be expected?

The distribution expected by the investor will be according to the specific investment property’s business plan, quarterly reports will be published and distributed. We might occasionally distribute additional capital to investors according to the properties' performance (cash flows) and whenever properties are refinanced or sold.

-

Can I cash out of my investment at any time?

No, that is not possible. Commercial real estate investment projects have a longer duration than traditional liquid bonds and stock. We provide a projected hold period timeline initially during the investment, and throughout the investment's life period. Cash distributions occur during the holding period of the asset according to the cash flows from the property. Investors might not attain their full investment back until the property is sold/refinanced or until the investors cash out with profits from the disposition. Again, we give no guarantees on return on investment.

Contact Us

Contact Us to Get Started

Location:

2390 E Camelback Road, Suite 130, Phoenix, AZ 85016

Email:

info@omequities.com

Call:

(480) 696-5590